Are Increasing Property Values Good? The Hidden Cost of Property Inflation

- June 16, 2023

The Hidden Cost of Property Inflation

While increasing home values can be seen as a positive outcome for homeowners, it can also have negative effects on certain individuals and communities.

Rising home values can bring affordability issues and social unrest. As home prices increase it becomes harder for aspiring owners to purchase a home. As prices increase the barrier to homeownership becomes harder, leading to housing affordability challenges.

Displacement and gentrification are other key issues brought about by increasing property values. As home values rise in certain neighborhoods, it can lead to the displacement of long-time residents who can no longer afford to live there. When home values increase, property taxes often follow suit. While this can benefit local governments in terms of increased revenue, it can place a burden on homeowners, particularly those on fixed incomes or with limited financial resources. Gentrification often accompanies increasing home values, resulting in the transformation of communities and potential cultural and socioeconomic displacement.

Inequality and wealth disparity increase with rising home values by benefiting homeowners who already possess property while widening the wealth gap with individuals who do not own property. This can deepen social and economic divisions within a society. It is estimated that homeowners are up to 40x wealthier than renters. Additionally, when prices go up, aspiring homeowners often tend to give up as they feel their savings will never grow at the same rate at which home prices increase.

Lastly, a rapid increase in home values can lead to an unsustainable housing market bubble. If the bubble bursts, it can result in a significant decline in home values, leaving homeowners with mortgages larger than the worth of their homes and potentially triggering economic instability, something similar to the events that caused the 08-09 financial crisis.

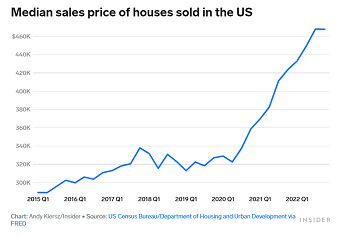

Price Increases and Increased Mortgage Rates Impact Housing Affordability

While demand has been buoyed by increasing property values and an increase in mortgage rates, there is still very limited inventory out there. This will result in property values staying elevated for the following months. Record-low interest rates lured millions of Americans to purchase homes or refinance their property between 2020 and 2022 forcing intense competition for a limited number of homes, which drove prices to new records. Home prices were up by an astounding 18.8% in 2021 alone and over 5.8% in 2022 according to the S&P CoreLogic Case-Shiller Index.

The gap between new home constructions and household formation reached a high of 6.5 million in 2022, according to Realtor.com. Data from the NAR shows that as of January, existing inventory stood at a 2.9-month supply. That’s below the five to six months of inventory that experts recommend for a neutral real-estate market.

Housing affordability continues to be a key social challenge. According to Yahoo! Finance, housing has become so unaffordable that over 75% of homes on the market are too expensive for the average buyer. That means that over 50% of aspiring homeowners are competing for only 25% of the inventory available for sale, which is already at record lows. Thanks to elevated mortgage rates, the housing market is missing around 320,000 homes priced at or below $256,000 – the maximum price a middle-income buyer earning up to $75,000 can afford.

On the positive side, the millions of consumers that were able to lock in a sub-4 % mortgage seem to have made a positive decision. In addition, property owners that bought their homes prior to the recent increase in values are sitting on nice equity gains. Although these paper gains do not mean much if they do not sell it does bring peace of mind a nice nest egg in case of emergency.